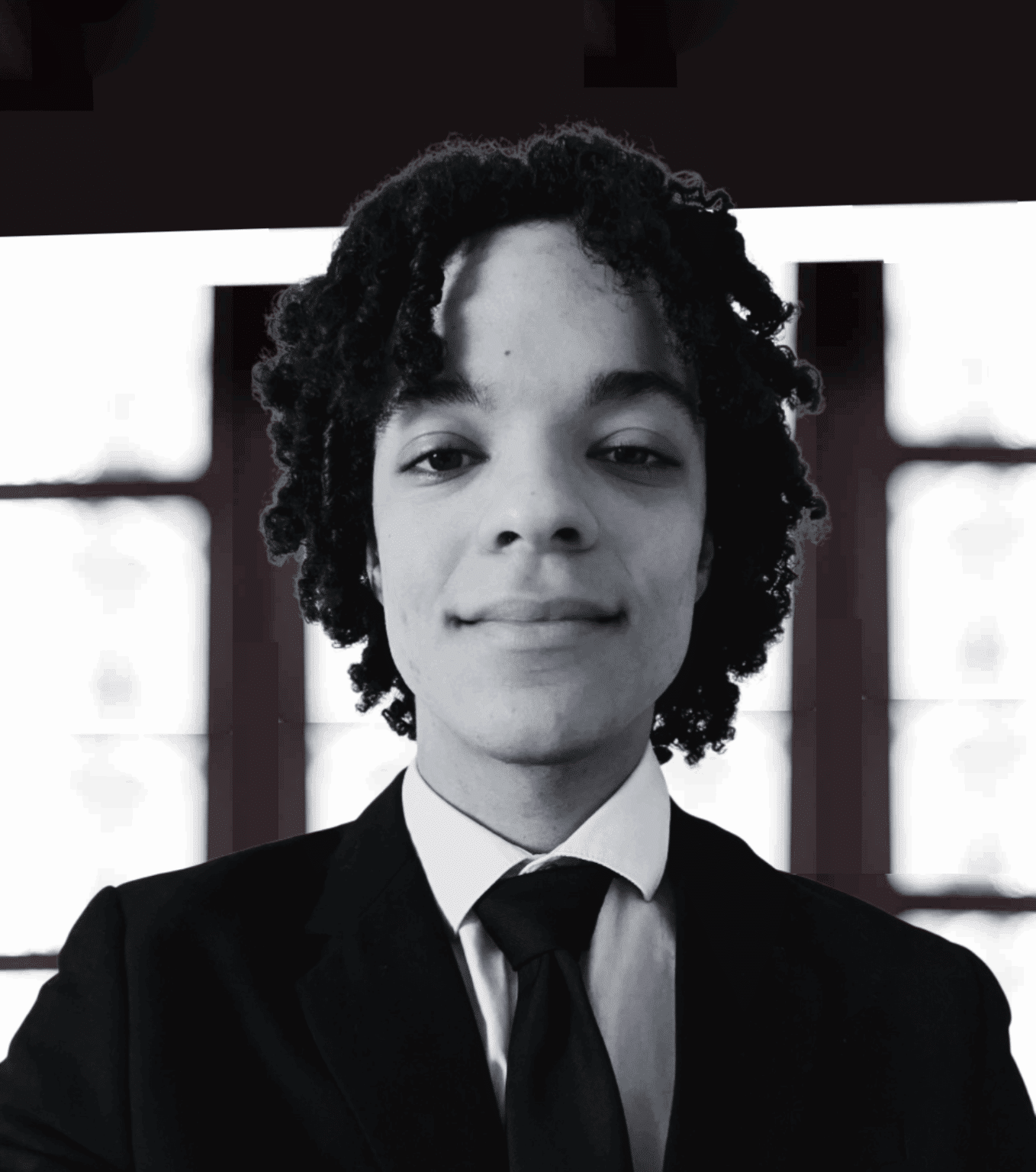

Laurence HONTARREDE

Chief Strategic and Marketing officer, BNP Paribas Cardif

While some obstacles may be easy to overcome to improve cross-border supply of insurance products, others are more difficult to apprehend: On the one hand, differences in national legislation, like civil law, insurance contract law, taxation, which is an important barrier preventing from directly providing financial services cross-border. Differences relating to insurance fraud may also play a role in the decision to offer products cross-border. On the other hand, insurance products are designed in function of the environment of the country in which the product is to be sold: product design, risk pricing, claims handling and support are all influenced by the local market and regulatory conditions. A decision to enter a foreign market therefore requires an extensive understanding of and compliance with the regulatory and supervisory requirements of that market.

Further examples of the many factors that must be considered as part of an insurer’s risk calculation include:

– Life insurance products are dependent on the national civil laws and taxation regime of the markets in which the products are offered; account needs also to be taken of the local taxation conditions

– Anti-money laundering legislation is a barrier that prevents the provision of life insurance products on a cross-border base

– Health insurance is an area of Member State competence; the specific role and tasks of private health insurers therefore depend on the national health system.

Some barriers can be overcome by digitalization and innovation which could ease the conclusion of cross-border contracts: technology can enable insurers to conclude distance contracts by verifying the identity of potential clients with electronic signature, but this will only be possible if the legal environment allows insurers to use these technologies easily. Technology can also assist insurers in collecting easily more information about other markets or about foreign customers. It can provide them with more sophisticated data about individual risk.

The insurance sector is embracing digitalization, to respond quickly and efficiently to new customers’ expectations. In order to avoid any form of financial exclusion, the industry’s business model is evolving towards a multichannel environment where insurance services are made available through digitalized channels as well as through more traditional channels. The regulatory initiatives should not favor one channel

over the other, thereby allowing the diversity of channels to benefit consumers, whose cultures, needs and preferences vary between markets. In addition, financial education in the digital environment should become a priority for all stakeholders, in particular public authorities.

It can also be reminded that the General Data Protection Regulation and the NIS Directive already offer a high level of protection. Insurers remain vigilant in order to ensure consumer’s trusts, manage risks and cover new business opportunities. In addition, the EU-level framework must take into account differences in the nature of products: a “one-size-fits-all” approach, which does not recognize the specific features of insurance products, is likely to be damaging for the industry and, ultimately, for consumers.

Regulatory initiatives should have a clear benefit for consumers and not restrict their access to a wide and diverse range of appropriate insurance products and services. When deciding on new consumer policies and specific consumer protection legislation, the benefits to consumers and their needs should be thoroughly assessed: benefits must then be balanced against the costs of implementation and the risk of overregulation that can hamper product innovation and growth and requirements should be tailored proportionate and adapted to consumer needs. Moreover, there are only very recently agreed new rules under IDD, just entered into force, which enhance conduct of business rules for the entire sales process and further strengthen the level of consumer protection as well as the new data protection framework. These rules apply to any new digital technologies that impact the distribution of insurance products. (April 2016)

Html code here! Replace this with any non empty text and that's it.