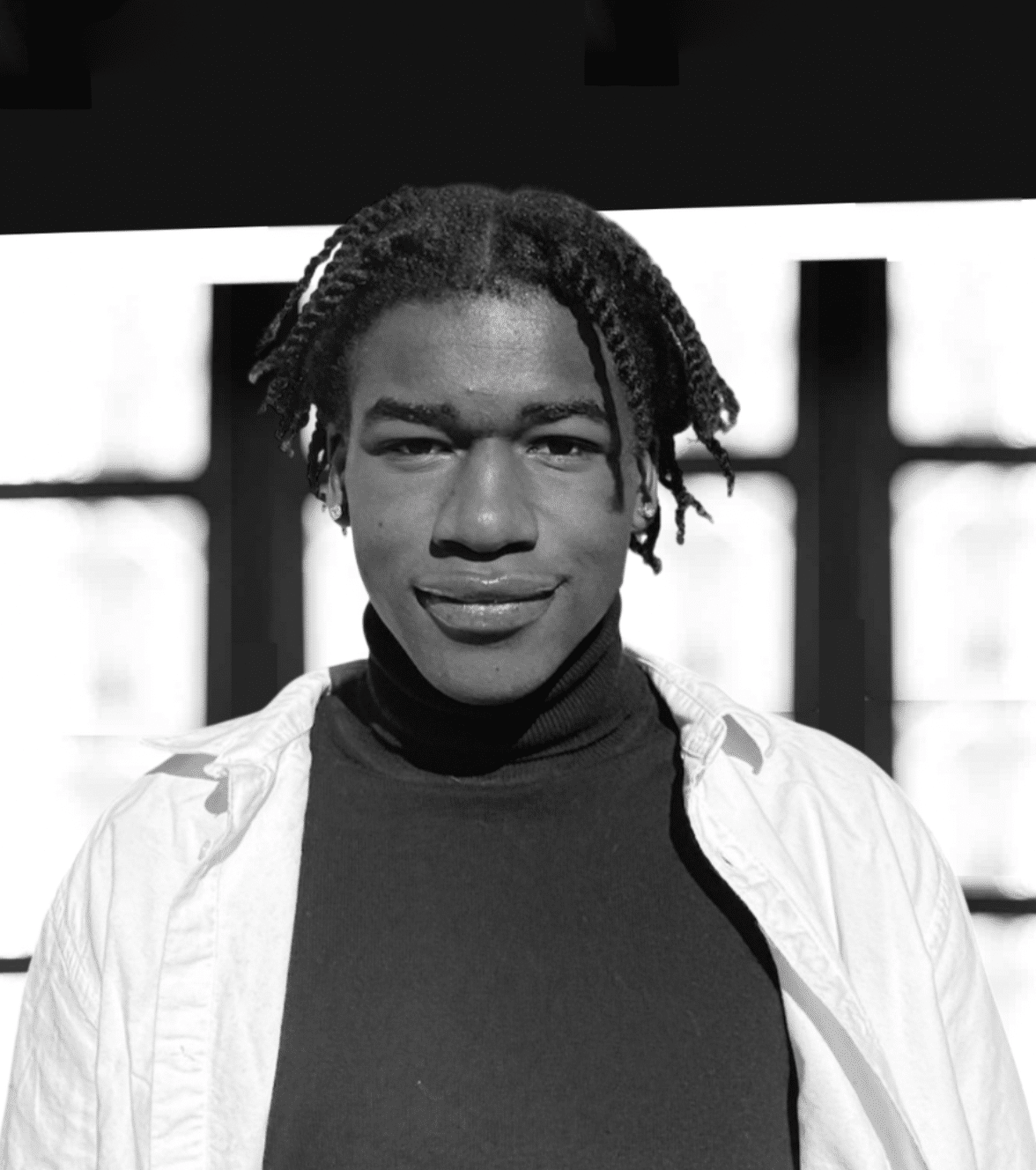

Hugues SIBILLE President of the French Committee for Social Impact Investment [vc_btn title= »Télécharger l’article » style= »outline » color= »blue » align= »right » i_icon_fontawesome= »fa fa-file-pdf-o » add_icon= »true » link= »url:http%3A%2F%2Fprod.confrontations.org%2Fwp-content%2Fuploads%2F2016%2F03%2FInterface-confrontations-EN-99-P4.pdf||target:%20_blank »] Html code here! Replace this with any non empty text and that's it. In June 2013, B. Hamon asked me to represent France in a G8 task force on social impact investment. I accepted for three reasons. Because it was the Minister for the Social and Solidarity Economy who was asking, which was a reflection of the French government’s position on the matter. Because France must take part in international discussions on the subject, and not just drop it simply because the British and Americans have taken the leading role. And because we are going through a period of social and economic change and new social approaches are needed. I am interested in finding out how we can “go from social spending to social investment” while continuing to adhere

Ce contenu est réservé aux abonné(e)s. Vous souhaitez vous abonner ? Merci de cliquer sur le lien ci-après -> S'abonner