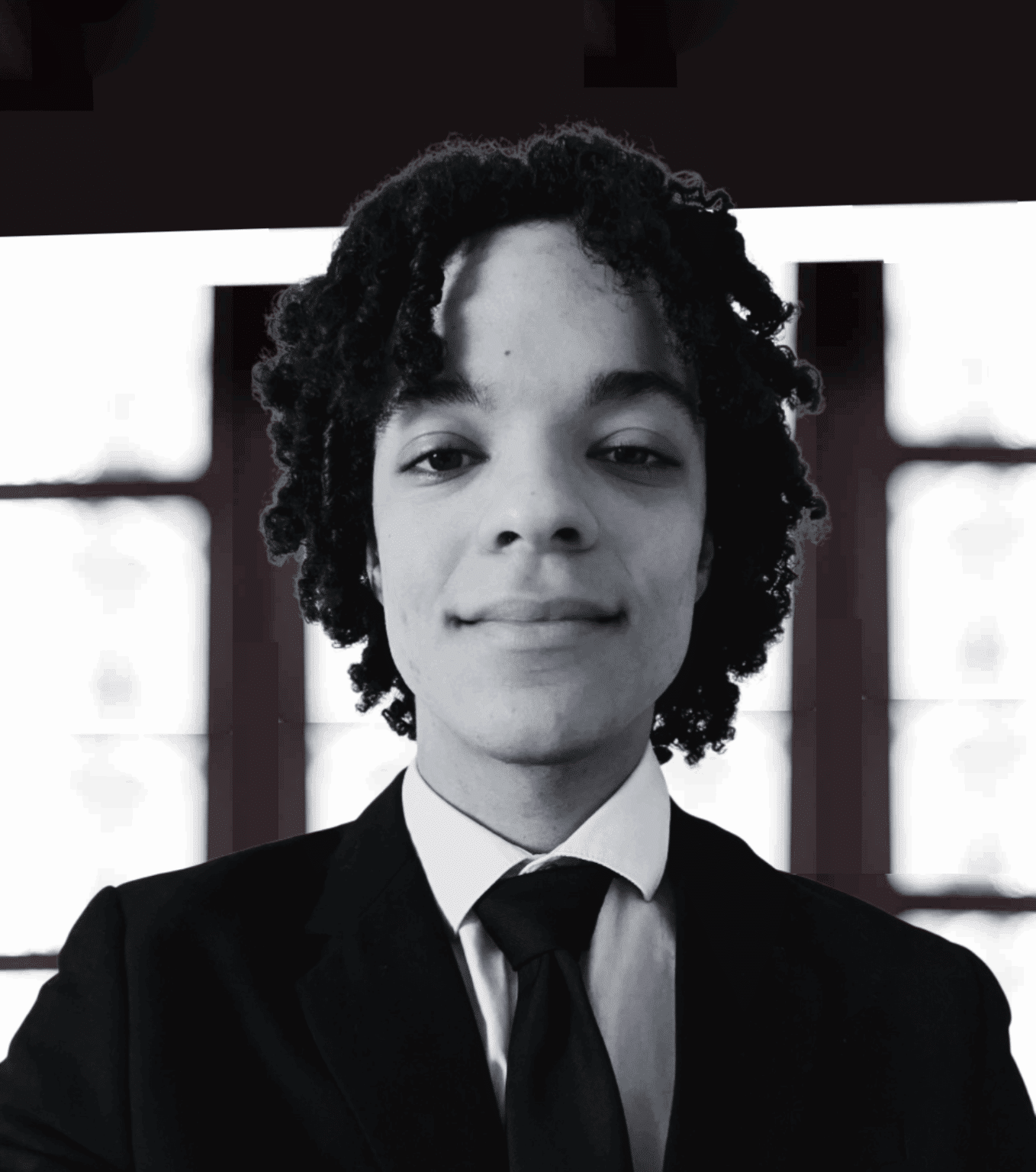

Jean-Paul GAUZES

President of EFRAG

In view of the application of the IFRS 9 standard, institutional investors are raising questions – indeed concerns – about the accounting treatment of long-term investments. The standard, which according to the IASB* is designed to reduce banking risk, could create serious problems for non-bank investors depending on how it is interpreted.

It provides that all equity investments must be measured at fair value, with value changes recognised in the profit and loss statement.

This would result in volatility not directly correlated with economic strategy. Unrealised value changes could be reported in a separate reserve (OCI, Other Comprehensive Income); however, it will not be possible to recognise realised gains and losses in profit and loss because the standard prohibits the recycling of realised gains.

Furthermore, IFRS9 provides for greater diversity in accounting treatments depending on the type of investment (shares or bonds). As a result of this diversity, the accounting of assets (such as shares, bonds and real estate) in mixed investment portfolios will be more difficult. However, for investors with large portfolios, asset diversification is essential to reduce risk and improve the rate of return.

The European Parliament has also expressed concern, in a report by Theodor Dumitru Stolojan on International Accounting Standards evaluation.

Uncertainty about the potentially negative impact of IFRS 9 on long-term investment has not impeded its adoption. Nevertheless, at the request of the European Parliament, the implementation of IFRS 9 will be closely monitored, and an impact assessment will be performed to determine its effect on investment decisions.

However, it should be stressed how difficult it will be to measure the impact of IFRS 9 independently of other factors that affect investment decisions, such as market conditions, taxation and prudential requirements.

The European Financial Reporting Advisory Group (EFRAG) has set up a research project to develop a credit loss impairment model adapted for investment in equity instruments. To this end, it will no doubt be necessary to establish a working definition of strategic investment. But the definition of long-term investment is not unequivocal, because it is difficult to represent the economic situation in accounting terms. It in fact makes reference to concepts that are not accounting concepts (the difference between short and long-term investors) and to balances that accounting treatments do not monitor (assets/liabilities, asset diversification with different accounting treatments, short-term volatility and long-term changes in the value of a portfolio).

EFRAG expects to be able to publish its proposals in the first half of 2018. The fact remains that long-term investment requires a constrained environment in addition to accounting rules: restrictions on the distribution of profits, specific prudential rules, strict governance and regulated long-term liabilities.

*The International Accounting Standards Board is a private organisation based in London, which develops accounting standards. The European Commission carries out a posteriori monitoring based on the advice of EFRAG.

**A private-sector committee of technical experts, established in 2001 to advise the Commission on the adoption of international financial reporting standards (IFRS).