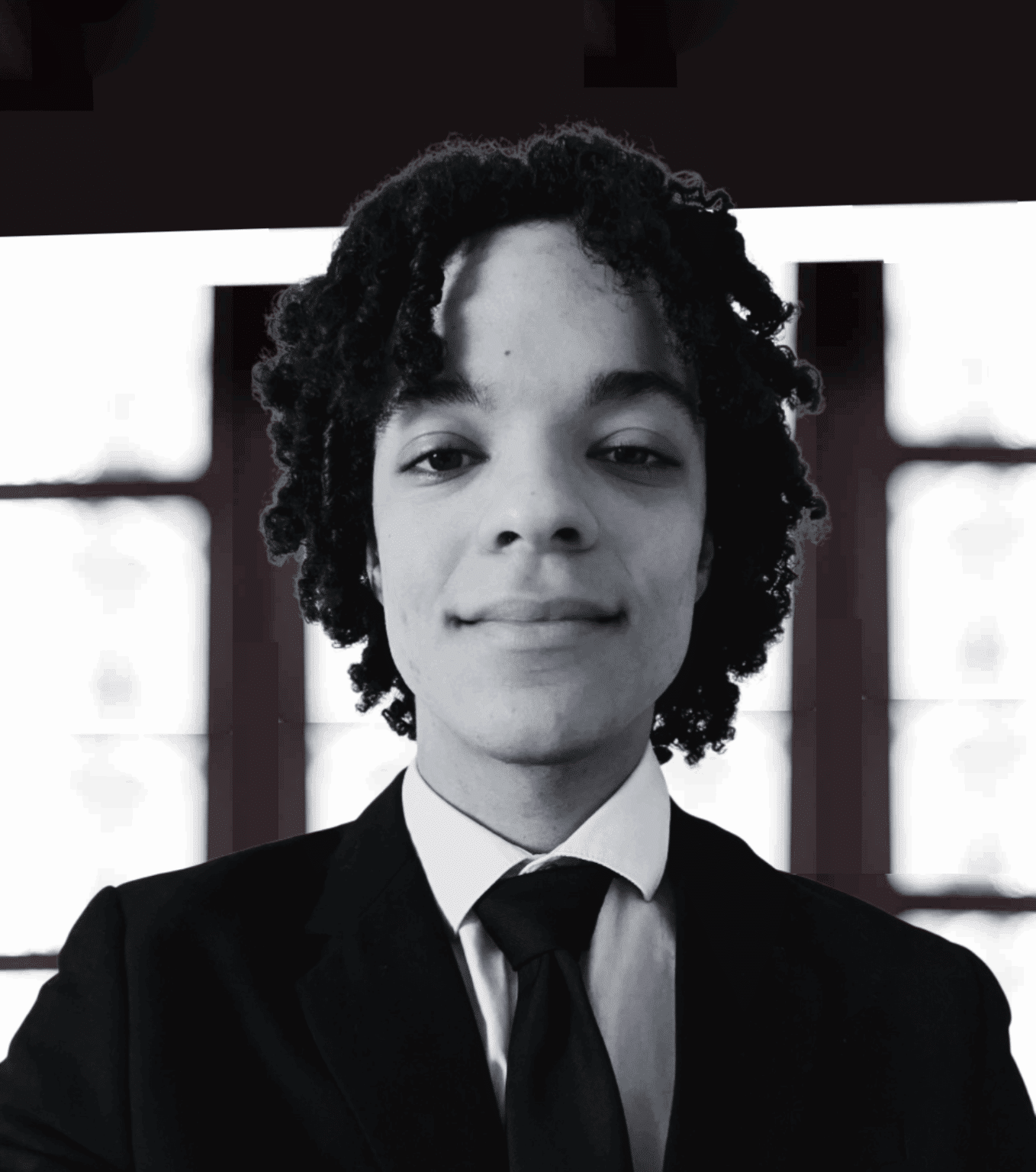

Marie-France BAUD

Director of the Brussels office, Confrontations Europe

Html code here! Replace this with any non empty text and that's it.

By creating a 28-member Capital Markets Union (CMU), the Commission aims to “unlock frozen capital to revitalise the economy”, according to the words of the Commissioner for Financial Services, Lord Hill. The CMU will make it easier to channel available savings into the productive economy, broaden the range of funding sources for SMEs and remove the obstacles to cross-border investments. Given the economic challenges that Europe is facing right now, the CMU is a major initiative that is in keeping with the Commission’s priority goal of promoting growth and employment. The Green Paper opens the consultation on preparing a plan of action.

The CMU sits at the confluence of several issues: economic growth, investment financing, the allocation of savings and taxation. The underlying idea is to tackle problems relating to investment, lending and savings within the current context of risk aversion. The goal, once the financial situation is more stable, is to make it easier for growing businesses to access the capital markets. Is recourse to the capital market an inevitable structural trend? In fact, only a small number of fast-growing companies are concerned; the CMU targets a minority of SMEs, not all of them. The debate on capital market integration has been going on for years. Since the 90s, Europe has been striving to create a deep, liquid market through various regulations but has failed to prevent its fragmentation. Indeed, unequal access to the capital markets is a big problem in the Eurozone because of operational obstacles and the sovereign debt crisis, which has accentuated national cultural biases. It is still much easier in countries that are not subject to such tensions, and for large companies.

The dual economic purpose of this initiative – to promote stability and growth – ensures its legitimacy. However, it does raise a number of questions: how might the goals of promoting growth and facilitating access to capital be turned into practical measures?

The Green Paper lays the foundations for increasing the supply of credit, through securitisation and private placement. Securitisation could generate €20 billion of funds for businesses. It would have to be underpinned by high European standards of quality, transparency and legal certainty, as it does engender mistrust. Private placement is a less controversial solution and is expanding rapidly in France and Germany. Lastly, the review of the Prospectus Directive should reduce the heavy administrative burden for businesses, particularly SMEs, and make it easier for them to raise capital while maintaining investor protection.

Giving a purpose to savings: how to attract the attention of private investors? This is addressed only very briefly in the Green Paper, even though it is vital to channel savings into the capital markets. According to ECB statistics, 42% of household savings in the Eurozone are invested in financial products or deposited in banks; this compares with 15% in the United States, where households prefer to invest in shares and mutual investment funds. This helps keep the capital market buoyant and gives it a certain depth.

It is by no means guaranteed that the new ELTIF1 regulation, which is being hailed as a major breakthrough, will attract households and institutional investors. The EIOPA2 is introducing an individual retirement saving account to encourage households to invest in the capital markets, with a long-term option. The idea is not to harmonise national pension schemes but to offer an additional (29th) scheme with a pan-European reach.

Other points of vigilance: the CMU needs powerful investment banks and institutional investors to work. What will happens after the structural reform of the banking sector is of the utmost strategic importance. At institutional level, a consistent approach to monitoring both people and products is vital: what role could ESMA, the European Securities and Markets Authority, play?

1 European Long-Term Investment Fund

2 European Insurance and Occupational Pensions Authority

A long road ahead

The Green Paper is just one of a whole host of initiatives. At a first glance, it seems that there is nothing to distinguish it from the others, since it is just a framework document[1]. But the debate is only just starting. The Commission’s agenda spans several topics, including rights attached to securities, prudential rules for insurers and pension funds, corporate bankruptcy law, financial information and transparency, the infrastructure framework in the Union and taxation. All these topics are potentially relevant to the development of such an ambitious project. The CMU is also a long-term project, which we cannot expect to stimulate growth in the short term; it will only be able to influence potential growth.

But one essential ingredient is missing and that is trust. Trust is something that cannot be imposed upon individual investors against their will, especially if they lack the basic knowledge of how capital markets work. It is glaringly absent from the Green Paper. The Nordic countries have shown that developing a specific culture to support the groundwork produces convincing results, which can be measured by the success of Nordic stock exchanges in financing businesses. And technology plays an instrumental role in this.

Let’s use this consultation to push this subject forward too.

Marie-France BAUD