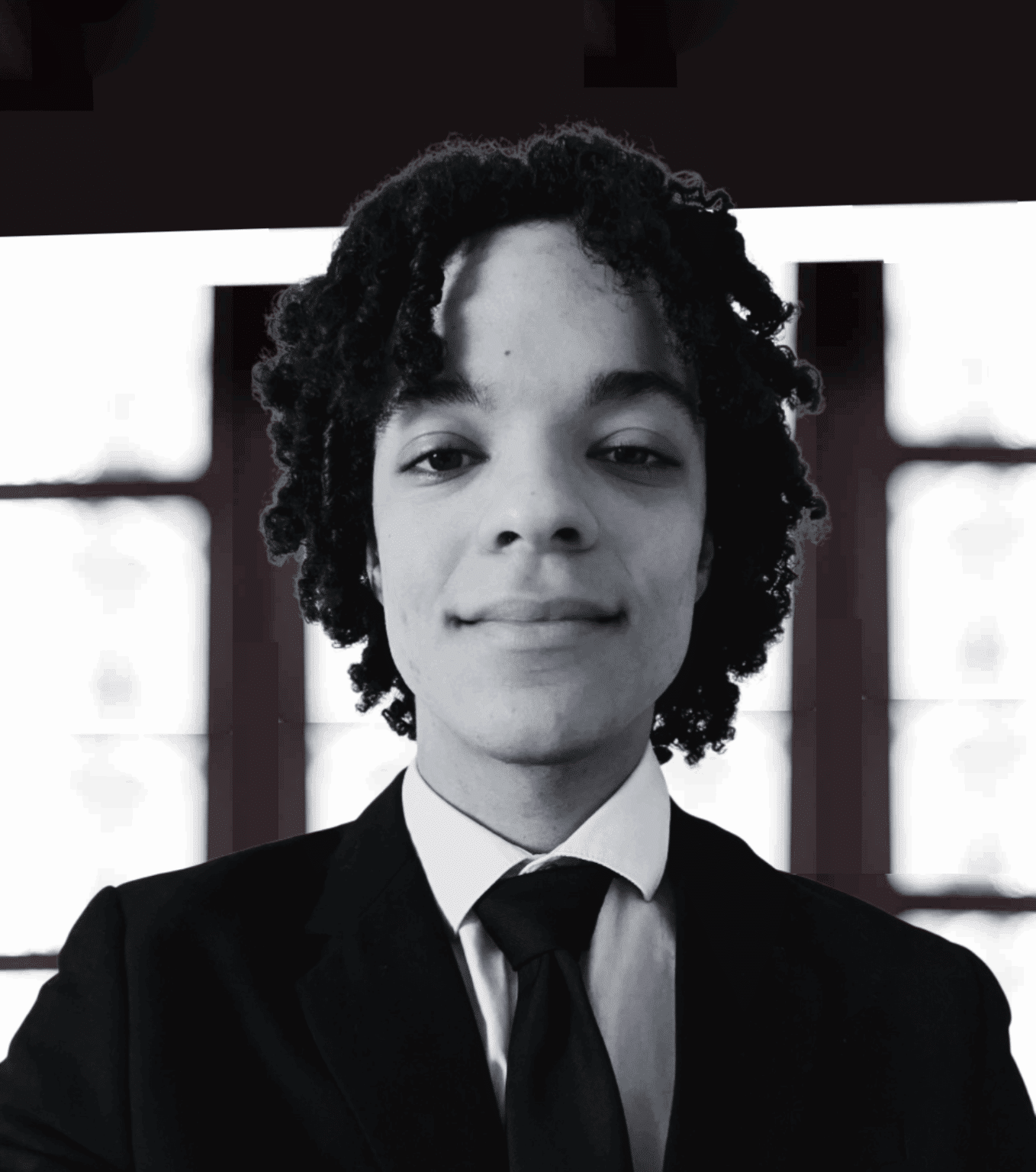

Michel AGLIETTA

Emeritus Professor of Economic Science at the University of Paris X-Nanterre Scientific advisor at CEPII

Html code here! Replace this with any non empty text and that's it.

Significant progress was made in 2012 with the treaty on stability, coordination and governance (TSCG)(1). The coordina tion process consists of assessment procedures carried out by independent bodies, namely the High Councils of Public Finances set up in each member country of the Eurozone. National governments are still responsible for budget development but the discussions between them and the EU institutions during the European Semesters aim at alleviating discrepancies in actual fiscal policies relative to commitments enshrined in the 2012-17 medium-term stability programs . Unfortunately, the rules adopted under Germany’s leadership are a hindrance. The main problem lies in the definition of the golden rule: the structural fiscal balance that every country must achieve incorporates all spending, including public investment, which means that public investment must be self-financed from an equivalent surplus on current expenditure. This is an awkward requirement since public investment generates future revenue, either directly (e.g. motorway tolls) or indirectly because it is a factor of growth (e.g. R&D, education). Every infrastructure, energy efficiency or human capital investment whose social return is over the cost of financing that is very low, pays for itself.

A European budget committee

The substance and procedures of budget cooperation must be improved. The role of the High Councils of Public Finance in defining procedures should be increased. These independent evaluation bodies, which issue opinions and recommendations, could give expert advice to governments on the possibility – under certain circumstances – of deviating from an overly-simplistic rule. Furthermore, bringing the high councils together under the umbrella of a European budget committee would be a further step towards fiscal coordination and therefore towards improving fiscal policy in the Eurozone. National parliaments could participate directly in the budget coordination process whether the evaluation delivered by the committee were examined and discussed in a conference of representatives of national parliaments. This would introduce a touch of democracy into a procedure that has been captured by an intergovernmental monitoring.

A European unemployment insurance system?

When discussing the content of the budget, it is important to remember exactly what its functions are: to stabilise cyclical fluctuations, redistribute revenues and allocate resources to the production of public goods. The fact that the redistribution of revenue is prevented by Germany’s objections does not mean that the other two functions should be neglected. To stabilise fluctuations, a system of insur ance against asymmetric shocks is needed. One option would be to set up a European unemployment insurance system(2). This would require the introduction of a European, open-ended employment contract negotiated between the national governments, which would entitle the holder to European unemployment benefits in addition to national benefits. The aim would be to balance the books of the unemployment insurance system over the Eurozone’s economic cycle, so that there is no net income redistribution between countries. However, such a system would be demanding in terms of European integration, as it would require some harmonisation of the labour market. Another more straightforward mechanism could be introduced(3) involving transfers between countries based on relative output gaps.

Reorganising the European budget

To fulfil its resource allocation function, the European budget must be reorganised to achieve the size and structure needed to finance the European public goods that are essential to a common growth ambition. Investing in the production of public goods (education and R&D) increases total factor productivity for the entire economy. An enlarged European budget must be developed and financed entirely by own resources. To achieve this, the European Parliament must be granted the authority to raise taxes and the Union must be authorised to issue bonds to attract presently idle private saving. Furthermore, to restore growth in Europe, a European financial intermediation capacity must be established. We must break away from the prevailing dogma that a public deficit is always a bad thing. Many long-term investment projects concern public goods to some extent. However, because the externalities generated are not automatically reflected in the capi- talised value of the investment, financial entities like public development banks, pension funds and sovereign wealth funds – whose liabilities are such that the holding of long-term assets constitutes their optimal allocation – are reticent to invest. Public policy is the only means of incentivising the private sector to reorient investment projects. To finance these projects, the financial intermediation system must be reorganised around a European fund. This fund would be capitalised through the European budget. It would issue bonds by leveraging institutional savings worldwide in order to provide loans and capital to financial entities that specialize in financing innovative investments.

Such measures would send a strong signal that the member countries have the political will to put the economic crisis behind them for good and empower Europe to tackle the challenges ahead.

1) The treaty defines a balanced budget as follows: a deficit below 3% of GDP and a structural deficit below 0.5% for countries with a debt/GDP ratio above 60%, and below 1% for other countries. Member countries with a debt ratio above 60% must aim, on average, to reduce their debt by 1/20 per year.

2) CAE (French Council of Economic Analysis), Note 3, April 2013

3) Notre Europe, “Blueprint for a Cyclical Shock Insurance in the Euro Area”, Studies and reports, no. 100, September 2013.